To raise money or not to raise money… the endless discussion in not only D2C, but also in more or less any other industry. Especially in the D2C space, you’ll hear lots of stigma around the topic of raising money to grow your business. Most of this is coming from people who think raising money from a VC (Venture Capital Firm) or PE (Private Equity Firm) is the only route to go down or from people who’ve either raised too early, raised too much, diluted themselves too thin, or a combination of all.

We’re not here to tell you what’s right or wrong… in fact we don’t know what’s right or wrong, and neither does anybody else, as it’s very specific to your individual company.

… But

What we’ll do in this newsletter is introduce you to some of the benefits we’ve experienced from raising capital, and talk a bit about the route that we’ve gone down.

If you enjoy this one, then stick around for the longer newsletter that’s coming out on Saturday, where we’ll go more into depth with the pros and cons of raising money, our thoughts on when you should do it, and our approach to raising $2.2 million in approximately 4 weeks. Alright, let’s jump into it.

Brief background into why we raised money in the first place

If you’ve read about us online, you’ve probably come across the fact that we bootstrapped our way from 0 to $40 million in under 40 months, and we have - for a long time - been fans of bootstrapping our way up. That being said, we also realized that there was a certain inflection point in our business where A) the unit economics on Paid Ads just didn’t make sense anymore and we realized that we needed big money to diversify our marketing efforts and B) We wanted to unlock the next level of growth and take our brand from $40 million to $100 million - and we couldn’t do that without the budget to strengthen our team and diversify our marketing channels.

When you start, focus. When you grow, diversify.

The price of attention is only going one way, and as you grow your brand, new customer acquisition on paid channels like Meta, TikTok, and Google becomes harder and harder. Relying solely on these channels to attract new customers would be a sure way to turn our P&L to a bloodbath in the long run.

We realized that we needed to diversify our marketing spend, because at some point - there’s just not enough juice to pull from Paid Ads, and your ads are essentially circling around the same people. Some of the ways to diversify your marketing spend includes retail, influencer marketing, programmatic, connected tv, Youtube - and many many more. Regardless of which path you want to go down, you’ll need money. And since we didn’t want to take budget from our already well-established and working paid channels, we needed to find the money elsewhere. Raising money from our network, angels, friends, family members, and colleagues allowed us to bet on not only more channels, but also a variety of different channels.

You are only as strong as your team

Going from 0 to $40 million, we’ve consistently kept our team lean & mean. Around 9 employees including co-founders. Not too small, not too big - but enough to move the ball fast and efficiently. However, what we realized along the way is that in order to go from $40 million to $100 million, we needed more knowledge, more brains, and more hands. We figured that the team that got us to $40 million, won’t be the same team that gets us to $100 million.

Let me give you an example…

One of the very specific things we needed the money for was increasing our Retail %-share of revenue from 8-10% to around 30-40%. Neither me, nor my co-founders, nor anybody on our team had vast experience in doing retail. So we figured that the only feasible way for us to triple or quadruple our Retails sales would be to A) Hire people who are a lot smarter than us in this field and B) Build a team whose only focus is to grow our retail sales. Now the question remains: Could we have increased our retail sales by a modest 5-10% without raising money and hiring additional staff? The answer: Yes, we probably could…But we definitely wouldn’t be able to 3x or 4x the retail sales in 12 months. Not only does it require substantial amounts of money to just get the competencies in-house, but it also requires a large investment to go into retail in the first place. Raising money allowed us to build the team and make the investments needed to get into retail and just recently close a larger deal with Walmart. Without the money, we probably wouldn’t be able to.

“Show me the incentive and I will show you the outcome”

This quote from Charlie Munger fits quite well with the experience we’ve had in regards to the advice we’ve gotten from partners, vendors, and business associates after they had invested in our company. Essentially what we’ve experienced is that the quality of the advice we started getting increased drastically, because now these people had skin in our game. In other words, everybody’s incentives were completely aligned.

Endnote on fundraising

Now, this newsletter is not meant to be a fairy-tale story about raising money, nor is it a recommendation to just go out and raise money at all costs. There are just as many reasons not to do it, as there is to do it. And there are also a plethora of things you need to consider before going down this route. In the next newsletter, which will come out on Sunday, we’ll dive deeper into the pros and cons, our thoughts on when raising money can be a good and a bad idea, what you need to think about, and lastly the exact approach we’ve taken.

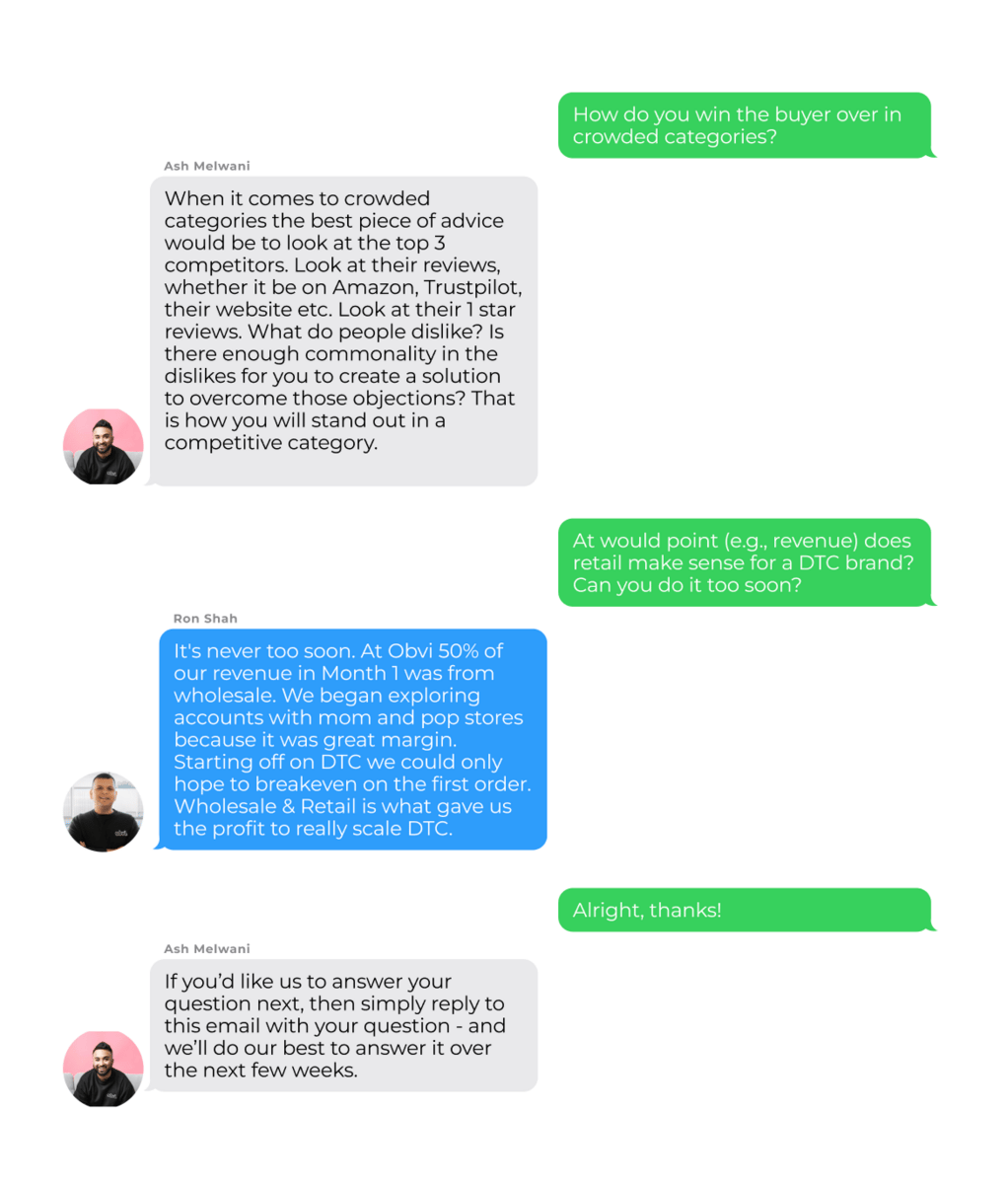

Let’s get to today's Q&A

If you enjoyed this newsletter, then make sure to share the enjoyment with your colleagues, partners, and friends.

Till we see you next time,

Yours truly,

Ron and Ash