Hey everyone,

It's time for another bite to chew on.

Here's something that might surprise you: We completely scrapped our traditional BFCM playbook this year.

Why?

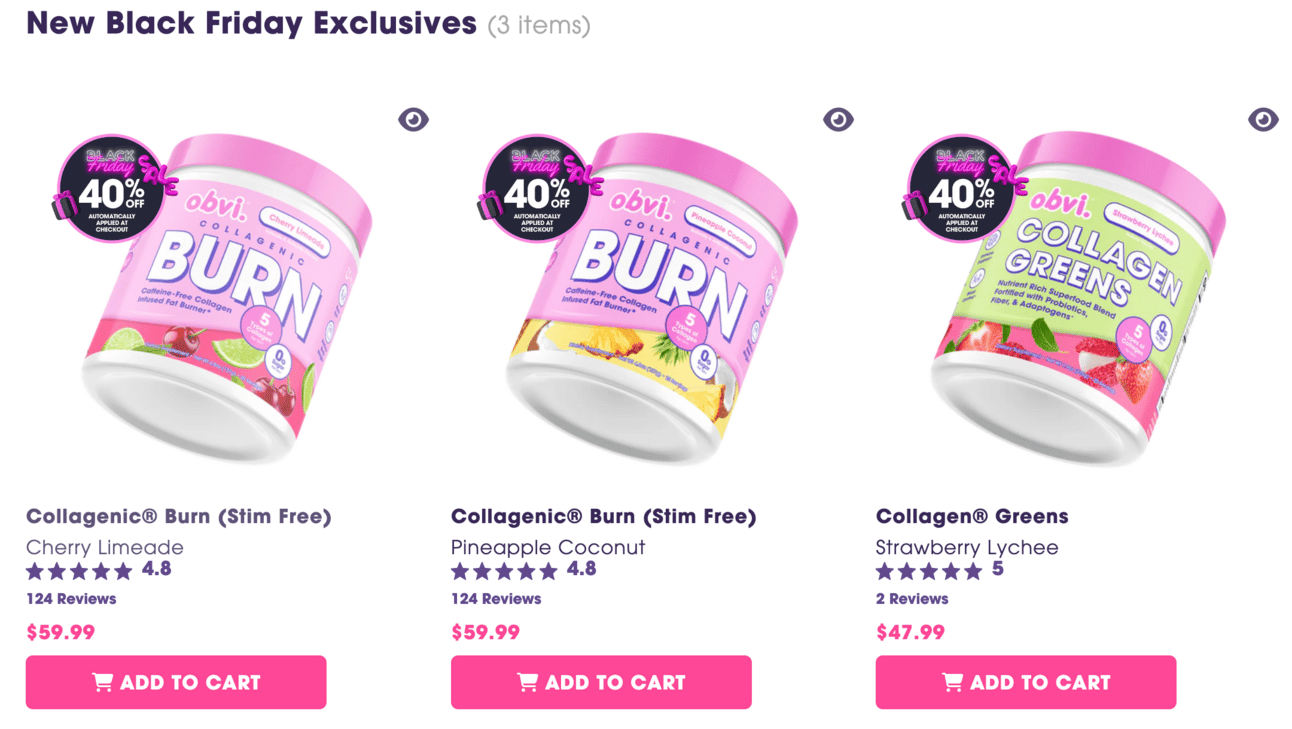

Because while most brands are still focused on Black Friday discounts and door-busters, we discovered something much more valuable - a way to capture holiday shoppers earlier, maintain margins, and drive more revenue than the standard "40% off" campaign.

The best part? Our competitors haven't caught on yet.

Today we're sharing our exact Q4 strategy - including the unexpected data point that changed everything for us, and the counter-intuitive approach that's already driving results.

Fair warning: This isn't your typical BFCM advice.

But if you're tired of racing to the bottom with discounts and want to try something different this year, you'll want to read this.

On the Menu

First - The early bird advantage

Second - Our Q4 Marketing Mix

Third - Beyond discounts

BONUS - Supply chain secrets

Before we get going - if you’re in DTC you know digital ad costs are higher than ever, and reaching new audiences is getting harder with every campaign.

Tatari changes the game by opening up TV as a performance channel, where brands are seeing digital-level metrics at lower costs—opening doors to audiences you can't reach on digital alone.

Remember when TV ads were just for the big brands with deep pockets?

Yeah, those days are over 👋

We've been watching more and more DTC brands make the leap to TV advertising, and there's a reason why → They're getting digital-level performance metrics at way better CPMs than the saturated Meta/Google landscape.

But here's the thing that most people don't realize: 50% of US consumers still watch traditional TV.

So when brands only advertise on streaming or digital platforms, they could be missing a chance to reach half their potential audience 😬

That's where Tatari comes in.

They're the only platform that lets you run and measure campaigns across ALL of TV - streaming, broadcast, cable, you name it. And they make it as simple as running Facebook ads.

Here's what caught our attention →

Measure ROAS and CAC just like your digital campaigns

Real-time optimization (yes, on TV!)

Smarter ad placements thanks to AI, no guesswork involved

The best part? You don't need any TV advertising experience. Their platform does the heavy lifting - from planning to measurement.

Why this matters right now →

Digital CACs aren't getting any cheaper

Q4 is coming (hello, BFCM 👀)

TV can actually build real brand legitimacy (unlike that 3-second TikTok view)

TV used to be this black box where you threw money in and hoped for the best. Tatari turns it into a performance channel you can actually measure and optimize.

Want to reach an entirely new audience that your competitors aren't?

Launch on Tatari for as little as $5k. And tell them Ron & Ash sent you 😉

The Early Bird Advantage

Remember midnight doorbusters and camping outside stores? That Black Friday doesn't exist anymore.

Here's a stat that changed our entire Q4 strategy → 45% of holiday shoppers start before Black Friday hits.

Even better - these early birds typically have bigger budgets and make multiple purchases throughout the season.

But there's another reality forcing brands' hands:

"If I'm running ads with my evergreen offer while my competitors are pushing Black Friday deals... who are you going to buy from?"

Some might say early discounting ruins the BFCM magic. We get it. But you have two choices - hold onto tradition while losing market share, or adapt and capture those early holiday shoppers.

Early launchers see →

Lower CPMs before the rush

More time to optimize campaigns

Better inventory planning

Stronger customer satisfaction

Fewer shipping headaches

We used to hold off for most of the month and try to retain as much margin as possible.

But with our competitors jumping into the discounting waters earlier and earlier, we knew we had to keep up or get left behind.

We chose to keep up, but knew we needed to go beyond just offering the big, juicy markdown.

Our Q4 Marketing Mix

Post-iOS BFCM demands a complete strategy overhaul. Simple budget increases on the “weekend-of” don't cut it anymore.

Our current approach breaks down across four key channels:

Meta

TikTok

Google

Influencer/Affiliate

Meta (50% of budget)

Still the powerhouse, but with a twist. We've learned to stop treating Meta like a pure performance channel during Q4. Instead, we're taking a more nuanced approach…

Keep your converting campaigns running - don't mess with what's already working. We've seen too many brands pull back spend pre-BFCM only to struggle ramping back up when CPMs spike.

Focus on creative testing now, not during the holiday rush. We're running our Q4 creative concepts through small-scale tests, identifying winners before CPMs climb.

Most importantly, use this time to build remarketing audiences. Every visitor now is a potential BFCM buyer later.

TikTok (25% of budget)

Here's where most brands get it wrong - they judge TikTok purely on immediate ROAS. We've learned to think differently about this platform during Q4.

First, understand that TikTok is fundamentally a discovery platform. Users aren't there to shop, they're there to be entertained.

Your content needs to match that mindset.

What's working for us on TikTok →

Behind-the-scenes product launches

Ingredient education (with a twist)

Customer transformation stories

Trend participation (when it makes sense)

The key is volume and speed. We're not precious about production quality - authenticity wins over polish every time on TikTok.

Pro tip: Take your best performing organic content and amplify it through paid.

We've seen significantly better results boosting proven winners versus creating ads from scratch.

Google (15% of budget)

While everyone focuses on social, don't sleep on search. During BFCM, protecting your brand terms becomes crucial.

We've seen competitors bid on our keywords every Q4, trying to capture our traffic during peak shopping season.

Your brand terms are your territory - defend them.

Influencer/Affiliate (10% of budget)

This might look like a small slice of the budget, but it's our secret weapon for Q4.

Here's why…

Facebook Live has become our highest-converting influencer activity. While most brands chase trending TikTokers, we're doubling down on Facebook's built-in notification system.

When an influencer goes live, their entire following gets an alert.

Boom! Instant reach. 💪

Our Facebook Live strategy →

Schedule multiple influencers throughout the month

Mix product education with exclusive offers

Enable live shopping features

Create urgency with limited-time bundles

Drive real-time engagement through Q&As

Community activation is another overlooked opportunity. We've built a massive Facebook community, and during BFCM, they become our biggest advocates.

We leverage our community by:

Previewing launches exclusively to members

Creating member-only bundles

Encouraging user-generated content

Rewarding sharing and referrals

Speaking of UGC, we're scaling content creation differently this year.

Instead of working with fewer, bigger influencers, we're partnering with micro-creators who actually use our products.

The results? More authentic content, better engagement rates, and significantly lower cost per piece of content.

Beyond Discounts: The Launch Strategy

Most brands miss the mark by focusing purely on discounts.

A perfect example: Last year our website crashed during launch. Instead of panic, we witnessed something remarkable - our community simply switched to our app and kept buying.

This taught us an invaluable lesson: product excitement trumps discounts.

Here is our 2024 approach →

New Product Intros

Breaking into skincare with face masks

Expanding hair care line

Limited edition flavors

Exclusive bundles

Technical Preparation

After last year's crash, we've completely revamped our launch process:

Start QA two weeks before launch

Work on separate themes

Test all features extensively

Have backup plans ready

Monitor server loads

By combining technical prep with new product launch strategy, we’re hoping to…

Drive higher AOV

Maintain margins

Create FOMO

Reward loyalty

Here's the magic → transform your sale into an event, not just a discount.

New products alongside promotions give customers compelling reasons to buy beyond price reductions.

BONUS - Supply Chain Secrets

Let's talk about the elephant in the room - funding inventory without crushing your cash flow.

Most brands default to chasing credit card points. That's shortsighted.

Our approach leverages:

Extended payment terms (tools like Parker offer 60-day interest-free terms)

Inventory financing options

Cash flow optimization strategies

There are lots of ways to fund your inventory these days. Think about them ahead of time and make sure you have them set up and ready to go.

This strategy lets you order inventory now and pay with revenue from the sale.

Sum it up

We're building in unprecedented times - pre-recession economy, post-inflation market, post-iOS tracking, and ongoing supply chain challenges.

But remember challenges can also create opportunity.

The winners this BFCM won't be the ones with the biggest discounts.

They'll be the brands that →

Start early to capture premium shoppers

Focus on excitement as well as discounts

Maintain margins while driving volume

Prepare their operations thoroughly

Adapt faster than their competition

We think the real lesson here is not to go into every BFCM with the same playbook. You change, the market changes, and your competition changes, every single year.

Prepare by being keenly aware of each of these factors, and then create ways to minimize your risks and leverage your strengths.

Want to dive deeper into our complete Q4 strategy?

Check out our recent podcast episode → Surprising Black Friday Strategies That Work where we break down everything we mention here from creative testing to inventory planning.

All the best,

Ron and Ash

P.S. Quick reminder - you need to start QAing NOW. Two weeks before launch is too late for major website changes, and inventory decisions should already be locked in.