Hey there,

Welcome back for another bite to chew on.

We hope you’re having a great weekend with your loved ones and are ready to crush this week ahead.

Last week we gave you the hard truths about our acquisition of Coffee Over Cardio.

As you know by now, we think it’s important to be open and honest about the ups and downs that we faced while building Obvi.

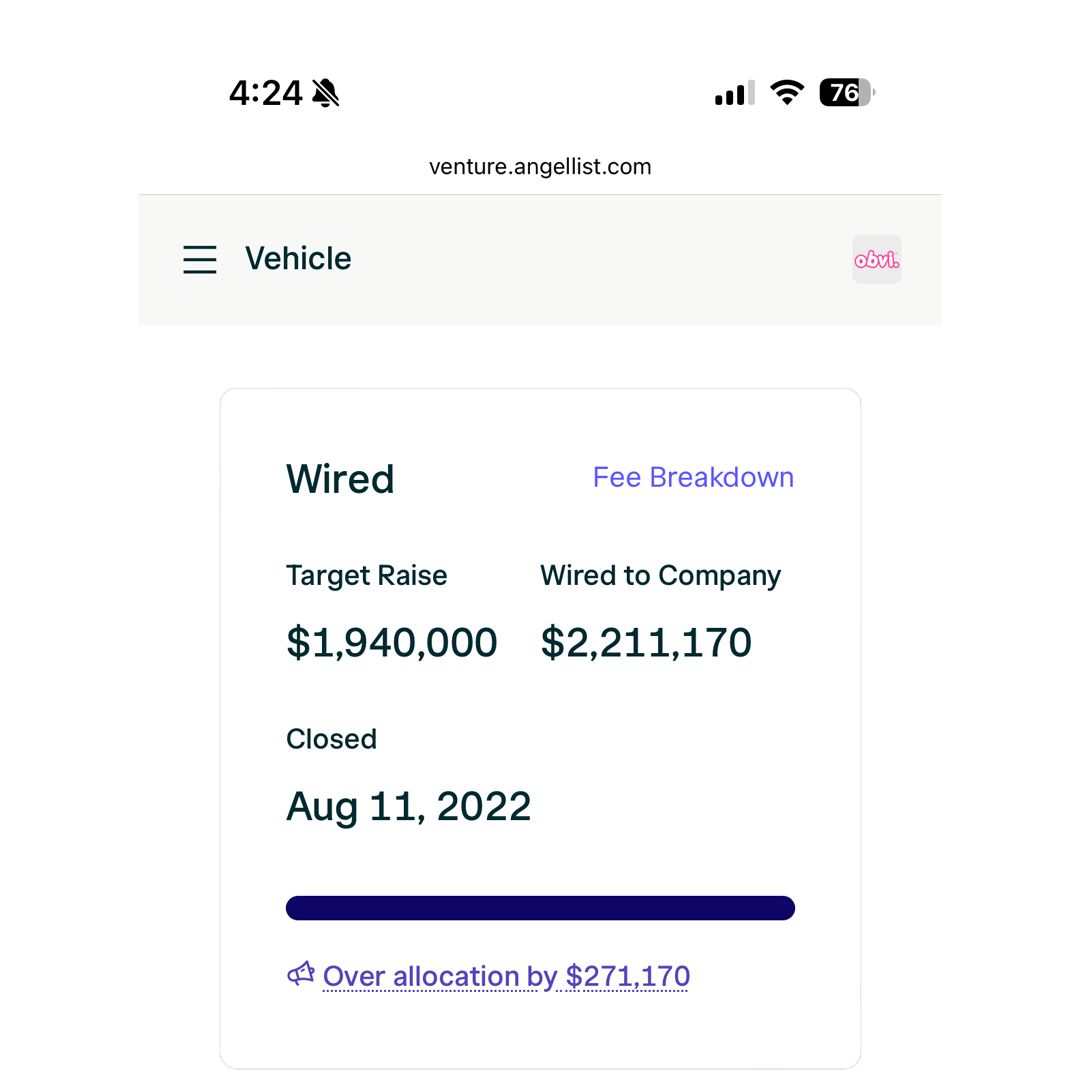

While that story included some painful lessons, this week we want to share one of our biggest wins: raising over $2.2 million.

This week's newsletter showcases the step by step of how we raised money from Angels in our network. We'll cover the surprises, challenges, and key lessons learned.

Grab a plate big enough for seconds. We’re about to dish out everything on our fundraising journey building Obvi.

When Hustle Alone Won’t Cut It

We had reached a critical point in Obvi’s journey after completely bootstrapping our way to $30M in revenue; our existing resources would eventually cap any ability to scale.

So, we took a step back and re-evaluated. We looked at what accessible market and growth trajectory goals looked like for us over the next 5 years.

We landed on reaching $100M+ in annual revenue across all channels.

How were we going to 4x our revenue? BIG changes.

We’d have to expand marketing channels beyond Facebook and TikTok, cement our offline retail distribution, speed up product innovation and R&D, address licensing deals, and hire more people.

Yeah, so all of it…

The capital to fund all of this in the timeframe we had outlined from ongoing profits wouldn’t be there, so we decided to raise funds.

Turning Fundraising into an eCommerce Playbook

Going the VC route would give up too much equity.

Going to the bank to just get a loan? No.

Instead, we wanted to raise capital from angels by tapping into our already existing network on Twitter, LinkedIn, etc.

We leveraged AngelList’s platform to pitch to our community.

What was really cool was that AngelList would just take a flat fee from what we raised. We were in complete control of all the parameters: minimum/maximum contributions, our evaluation, and they’d handle everything else.

So with just 5-6 questions, everything was set up with our own portal and we could even see the analytics of people checking us out.

We thought of it like a capital raising eCommerce storefront:

We set up our AngelList page with our deck, metrics, use of funds overview, and projected return forecasts.

Next, we blasted our fundraising page out through social media, email, and SMS promos - hoping our network would participate

The portal provided real-time analytics on link visits, engagement, and conversion rates - so we could tweak messaging and double down on referrals

Going as broad as we did helped secure funds beyond friends & family.

We partnered with some of our advisors, industry contacts, and past vendors & partners.

Our initial goal was to raise $500K.

We targeted people who would want to have a vested interest in us, and we could have a mutually stronger relationship with. Almost like creating our own partner group.

Here’s what was really cool though…

Week 1 we raised $250K, so we were already excited thinking we’d hit the goal in a few more weeks.

We raised another $250K in the next 4 days.

We hit our original goal, but people who invested in us had referrals waiting to come in if we had the space.

So back to AngelList, you can up your limit to whatever, adjusting everything at any time.

Those targeted investors that we thought could bring value, brought additional value from other people, creating our own investor referral network across Twitter, LinkedIn, everywhere.

Getting people who had invested in companies like this before who knew what the next steps would be were invaluable.

These people would give us sound advice because their own money was on the line.

Now we had this group of people that would root us on really until the end of the journey with this company.

8 weeks later, we crushed our original target more than 4x, up to $2.2 million.

$1.5 million coming from that referral network and out LinkedIn and Twitter platforms.

3... 2... 1… LIFT OFF!

Now we had to put that money to work.

Helping Out Ash

We needed to:

Diversify past Facebook, TikTok, and Google, especially at scale, and

Increase top line traffic, but we couldn’t keep spending what we were spending to do it.

So, how do you increase top line traffic?

We wanted to invest into these major aspects:

Really dive into influencer marketing

These would widen our reach and get previously untapped customers, but we wanted to make sure it wouldn’t take away from anything else that was already working.

Commercials and connected TV

Being able to set up these campaigns for retention and discovery would be huge

Licensing deals to get the macro effect of indirect brand impressions

Senior hires to bring critical expertise to guide and manage scaling challenges.

Building Out Retail

When we hit a certain milestone, $1M/mo, $1.5/mo, we’d always look to Ash to see how we’re going to increase it 👀…

(Can I get some help over here please?? - Ash)

Our DTC portion was always healthy.

Retail was just enough to say we did retail, when it was really pretty much just Amazon 😆

Our goal was to get retail to 30-40% of revenue, up from 8%.

The only way to even start to get there is to spend money.

XYZ amount of brokers, traveling salespeople, building relationships, sending out a LOT of packages, marketing materials, trade spend, etc.

It was all a cost.

We had to have that capital to say, “We need to see if this will work.”

Our strategy was:

Start with specialty, Vitamin Shoppe and GNC.

Hoping to win that and go to grocery, Albertsons, KeHe.

Then, Walmart, Target, Sam’s Club, Costco.

Each layer requiring more, more, and more money.

When an opportunity presented itself, getting that capital would give us the ability to actually explore it.

Supply chain & Manufacturing

Being able to order more, get better pricing, so we could get more ammo back to marketing.

Expanding the Team

We needed to be more strategic to bring people in who specialized in things we didn’t know.

Getting into retail, managing that retail team, having those connections.

An ad team, SMS, email, retention, all in house.

We needed people more knowledgeable on those subjects than us to take things and run with it. People with a fresh outlook beyond ourselves.

In today’s market, those people are costly.

Reflecting on Lessons & Surprises

We often look back on how overwhelmingly positive our fundraising journey was.

We raised way more than we ever aimed for. It taught us to think bigger.

We discovered unexpected connections that introduced us to new investors. We’ve continued to leverage how powerful a community can be to a brand. We brought on investors as partners to keep us accountable. It’s about more than just taking money. We wanted real, engaged partners.

When we finished everything, we propelled Obvi forward by raising over $2 million.

Our community unlocked the potential of what we have built Obvi into today.

Would we do it all again? Absolutely.

The group of trusted advisors we have built is more valuable than you can imagine or even put a price on. They almost act like our own influencers!

If you’re a newer brand looking to raise money, exhaust your network first. If you don’t have a network, there HAS to be someone in the company with a following to reach out to.

You never know who or what one conversation will connect you to down the line.

Tool of the Week

You can’t go out and raise capital every single day, and for most people, it’s not even possible to go out and raise capital.

The next best option, which we’ve used even after we’ve raised capital, is using Plastiq.

Plastiq lets us extend our runway, freeing up cash flow to fuel growth.

For people who don’t have the ability to raise capital,

and if you do have the ability to raise capital, who wouldn’t like an avenue for more cash flow?

It’s just a financially smart decision.

See how you can engineer good cash flow with Plastiq here.

Thanks for reading along!

We appreciate you spending time hearing part of our story and we hope you picked up an insight or two along the way.

Can't wait to create more memories & success stories right alongside you all - we look forward to serving you again on Wednesday.

All the best,

Ron & Ash